image credit: Incfile

image credit: Incfile Starting a business can be an exciting, yet daunting task. There are countless decisions to make and steps to take before your dream becomes a reality. One of the most important decisions you will make is choosing the right entity type for your business. This decision not only affects how much you pay in taxes but also impacts your personal liability.

IncFile is a company that provides assistance with forming LLCs, corporations, and other types of entities. Their services include everything from filing paperwork to obtaining necessary licenses and permits. In this comprehensive review and breakdown of IncFile’s services, we will examine their offerings in detail, including pricing, customer service, turnaround time, and overall value proposition.

Whether you’re just starting out or looking to upgrade your current business structure, this article aims to provide valuable insights into the world of IncFile and its role in helping entrepreneurs achieve success.

Overview Of IncFile’s Services

IncFile, a business formation service provider, offers an array of services and features that cater to the needs of entrepreneurs. Whether you are starting a new venture or looking for guidance on how to manage your existing one, IncFile has got you covered. Their industry expertise spans various fields, making them a reliable choice for anyone seeking professional assistance in their business ventures.

One thing that sets IncFile apart from other similar service providers is its range of customization options available for each package they offer. From basic filings to more complex legal requirements, each package comes with unique features tailored to meet specific client needs. Additionally, turnaround time is fast and efficient, ensuring prompt delivery of services without compromising quality.

Beyond providing top-notch services, IncFile also boasts a satisfaction guarantee policy that assures clients that if they are not satisfied with the end product or experience, they can request a refund – no questions asked. Furthermore, the company’s referral program encourages clients to refer others by offering incentives such as discounts on future purchases.

With such impressive service offerings and reputation among clients spanning over 15 years of operation, it is no wonder IncFile stands out as one of the best business formation companies in the market today.

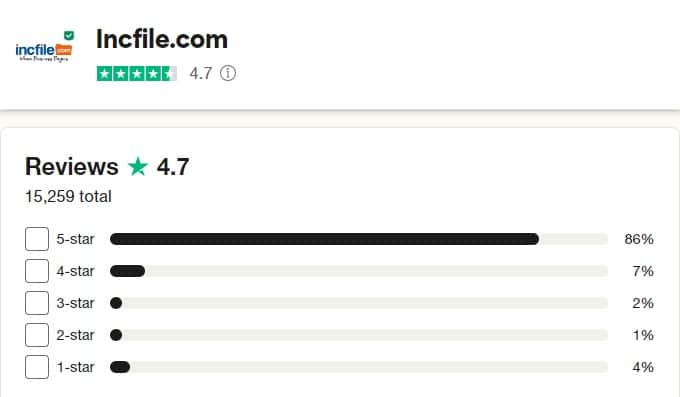

Trustpilot Review

image credit: Trustpilot

4.7 starts out of more than 15000 reviews which is phenomenal.

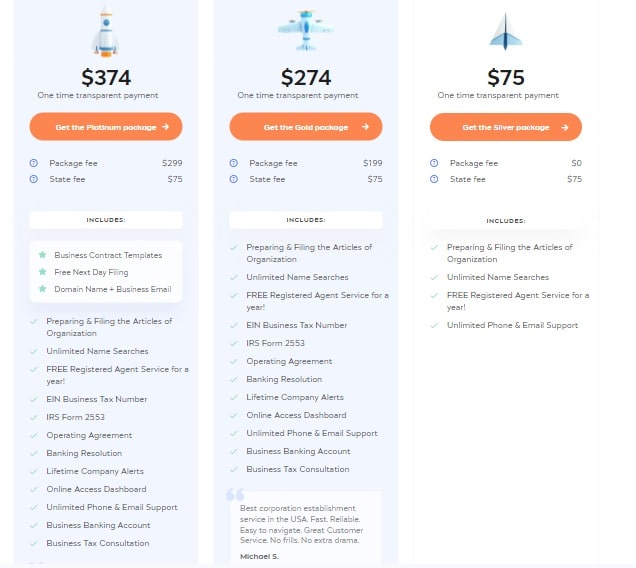

Pricing And Packages

IncFile offers three main pricing packages: Silver, Gold, and Platinum. Each package comes with its own set of features and benefits at varying subscription fees. Additionally, they offer various add-on options such as EIN/Tax ID numbers or registered agent services that can be added onto any package at an additional cost. Let me show you planning and pricing in case of LLC formation.

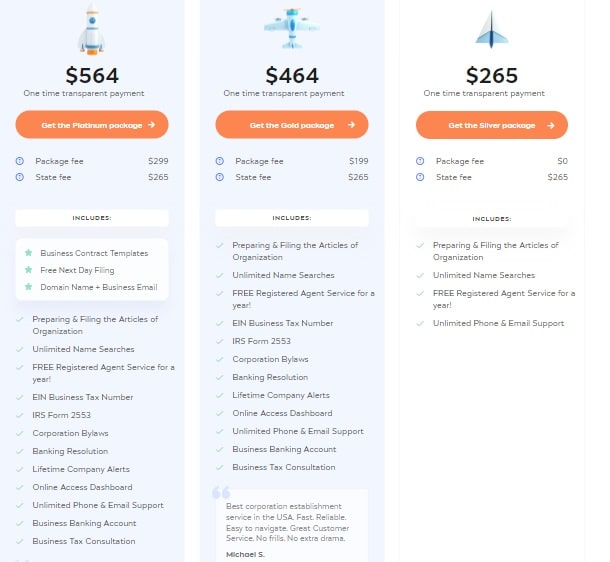

Similarly, here is the pricing and planning for S-Corp formation in Massachusetts-

When it comes to payment options, IncFile accepts all major credit cards and PayPal. With regards to discounts available, there are occasional promotions advertised on their website but no permanent discount programs in place. It is important to note that if you are unsatisfied with their service, IncFile does have a refund policy where they will issue a full refund within 60 days of purchase.

Pros And Cons

Pros

Affordable Pricing

IncFile stands out as one of the most budget-friendly options for LLC formation services when compared to competitors like LegalZoom, whose packages start at $79. With IncFile’s Silver Package, you only pay the state fee (which varies by state) to form an LLC, S corporation, or nonprofit. This package also includes the preparation and filing of the Articles of Organization, along with a complimentary first-year registered agent service and unlimited name searches.

User-Friendly Interface

IncFile offers a user-friendly online interface that makes it easy to purchase their services without any confusion. During the form-filling process, guided snippets provide assistance, and you can even engage with a live agent through a chatbox.

Online Storage and Tracking

IncFile provides convenient features, including an online tracking tool that sets it apart from many other premium options. This tool allows you to monitor the progress of your order and filing status online, enhancing your involvement in the process. Additionally, it offers online document storage, improving the overall user experience.

Complimentary Tax Consultation

Recognizing that many individuals lack expertise in finances and taxes, IncFile offers an exclusive one-hour consultation with a tax expert at no extra cost after signing up for their LLC formation services.

Cons

Numerous Add-ons and Upgrades

IncFile generates its revenue through add-ons and upgrades, which is how they can offer a basic plan for free. If you’re not careful or fail to understand the purpose of these add-on services, you might end up purchasing unnecessary services and spending more than you intended. Some add-on prices, such as a $70 fee for obtaining an Employer Identification Number (EIN), may seem excessive when you can obtain one for free elsewhere.

Customer Service Challenges

Many negative reviews about IncFile revolve around poor customer service and a lack of satisfactory resolutions to customer complaints, as reported on platforms like Trustpilot and other online review services. IncFile also has limited customer support hours (9 a.m.–6 p.m.) only on weekends, which can be inconvenient for urgent matters. The typical response time to email queries is usually around 24 hours.

Ease Of Use

One of the most impressive aspects of IncFile’s platform is its intuitive design and navigation simplicity. The user interface is clean and organized, making it easy to find what you’re looking for without getting lost in unnecessary menus or confusing options. This level of accessibility extends beyond the web version – IncFile also offers mobile optimization with full functionality on smartphones and tablets.

In addition to the excellent user interface, IncFile also provides helpful accessibility features such as large text size and contrast adjustment for those who may have visual impairments. The onboarding process is straightforward and streamlined, guiding users through each step with clear instructions and prompts. It’s no wonder that many customers have praised IncFile for its ease of use in their feedback about the platform.

Formation And Registration Process of an LLC

Forming an LLC involves selecting a business name, choosing a registered agent, filing the Certificate of Formation, and paying the necessary fees. Registering an LLC requires the filing of additional paperwork, such as the Articles of Organization, as well as payment of additional fees. The process of forming and registering an LLC with IncFile is straightforward and can be completed within a few hours.

Forming An LLC

When forming an LLC, entrepreneurs can enjoy several benefits such as liability protection and flexible taxation options. However, before diving into the registration process, it is important to understand state requirements for establishing a limited liability company. Each state has its own set of rules regarding name selection, filing fees, member roles, and annual maintenance among others.

One crucial aspect when creating an LLC is selecting a unique name that complies with state regulations. It should not be already in use by another registered business entity or too similar to prevent confusion.

Additionally, operating agreements are necessary to outline the company’s structure and management procedures while clarifying each member’s role within the organization. Taxes for LLCs vary depending on their classification – single-member or multi-member – with different options available like pass-through taxation or being taxed as an S corporation.

Lastly, annual maintenance tasks include updating any changes made to the company such as new members added or updated contact information. This will ensure compliance with state laws and prevent penalties from non-compliance issues down the line.

Registering An LLC

Registering an LLC requires complying with state-specific regulations that vary from one state to another. One critical step is selecting a unique name for your company that complies with state requirements and does not infringe on any existing trademarks. Conducting a name availability check can prevent rejection by state authorities due to similarities with other registered entities.

The next step is drafting operating agreements that outline the legal structure of the company and management procedures while clarifying each member’s role within the organization.

Taxation implications are another aspect that entrepreneurs should consider when registering an LLC. Single-member LLCs have different tax options than multi-member ones, such as pass-through taxation where profits flow directly to individual tax returns or being taxed as an S corporation, which allows businesses to avoid double taxation.

Lastly, maintaining annual records like updating changes made within the company ensures compliance with state laws and prevents penalties stemming from non-compliance issues down the line.

Formation & Registration Of C Corp

Filing Requirements for C Corporation Formation include submitting Articles of Incorporation to the appropriate state agency. The Articles of Incorporation need to include the corporation’s name, address, purpose, and the number of authorized shares. Registration Requirements for C Corporation Formation include filing a Certificate of Incorporation with the state and obtaining a Federal Employer Identification Number (FEIN).

Additionally, C Corporation formation requires the creation of corporate bylaws, appointment of directors, and issuance of stock certificates.

Filing Requirements

Ensuring proper compliance with state requirements is crucial when filing for the formation of a C corporation. The process involves several steps, including submitting legal documents such as Articles of Incorporation and registering with the Secretary of State’s office. Failure to adhere to these regulations may result in penalties or even rejection of the application.

After successful registration, corporations must also file annual reports and corporate taxes with their respective states. These filings help maintain compliance and transparency while providing critical information about the company’s financial status. Additionally, shareholder agreements must be established, outlining each investor’s rights and obligations within the organization.

A board of directors should also be appointed to oversee operations and make important decisions on behalf of shareholders. Forming a C corporation offers substantial liability protection for its owners but requires significant attention to detail during the filing process.

Registration Requirements

When forming a C corporation, it is essential to understand the registration requirements involved in the process. The filing process varies from state to state, and each has its own set of rules that must be followed for successful formation. One vital aspect involves ensuring proper documentation is submitted, including Articles of Incorporation and other necessary paperwork.

Before submitting any documents, it’s important to conduct a name availability search to ensure your desired company name isn’t already taken by another entity. Additionally, every state requires corporations to have a registered agent who can receive legal documents on behalf of the business. Once all required documentation is gathered, the next step involves filing with the Secretary of State’s office.

After successful registration comes annual reports and publication requirements that must be met within specific timeframes. Bylaws creation is also crucial in outlining how the corporation will operate and make decisions. Compliance with these various regulations helps maintain transparency while keeping businesses aligned with their respective states’ laws and regulations.

Additional Services And Upgrades

IncFile offers a variety of upgrade options for businesses of all sizes, from basic services to advanced business solutions. These upgrades range from registered agent services to business tax consultation, and allow customers to tailor their services to their specific needs. With regards to pricing, IncFile offers competitive and reasonable rates for additional services, and customers can save up to 25% when selecting a bundle of services.

Furthermore, customers have access to IncFile’s full library of resources, which offer helpful information and tips on the best course of action for individual businesses.

IncFile’s Upgrade Options

IncFile offers a range of upgrade options that can enhance your experience and give you more control over your business formation process. The premium package features additional services such as obtaining an EIN, filing annual reports, and creating corporate bylaws among other things. Customization options are also available to tailor the package to your specific needs.

The benefits of upgrading include saving time and money in the long run. By choosing an upgraded package, you won’t have to worry about missing important deadlines or paying for additional services later on. IncFile’s add ons and extra services allow you to further customize your package according to your unique requirements.

Final Verdict And Recommendations

One aspect that stands out when using their services is their user experience. The website is easy to navigate, and the process for incorporating a business or registering an LLC is straightforward. Additionally, they offer various tools and resources that can aid users in making informed decisions about their business structure.

Another key element of IncFile’s value proposition is customer feedback. Despite being relatively new compared to other incorporation companies, they have received overwhelmingly positive reviews from clients. Many customers note how efficient and reliable their service is while also praising their excellent customer support team.

When considering whether or not to use IncFile as your chosen incorporation service provider, one should also weigh up factors such as legal implications, industry compatibility, scalability, and long-term benefits. In terms of legal compliance and protection, IncFile offers comprehensive packages tailored to meet individual needs while ensuring that all necessary documents are filed correctly.

Furthermore, they cater to businesses across different sectors by providing specialized services relevant to each industry’s unique requirements. Lastly, choosing IncFile could be beneficial in the long run as they provide regular updates on any changes in regulations or laws affecting small businesses.